millaroussel80

About millaroussel80

Top No Credit Score Test Loans: A Comprehensive Examine

In today’s monetary panorama, obtaining a mortgage and not using a credit verify can be a viable option for individuals who might have poor credit histories or who need fast access to funds. No credit verify loans are designed to offer financial relief without the traditional boundaries that come with standard loans, corresponding to in depth credit score evaluations. This report delves into the highest no credit score test loans accessible, exploring their options, execs and cons, and the considerations borrowers should keep in mind.

What aren’t any Credit Verify Loans?

No credit check loans are financial merchandise that allow borrowers to entry funds with out the lender performing a radical evaluation of their credit score history. These loans are typically provided by alternative lenders, including payday lenders, online mortgage suppliers, and some credit score unions. The absence of a credit examine can expedite the loan approval process, making it engaging for these in urgent need of cash.

Forms of No Credit Check Loans

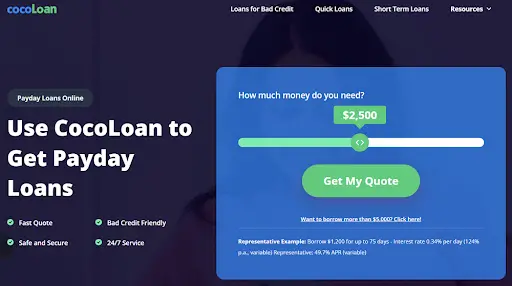

- Payday Loans:

– Overview: Payday loans are short-time period loans which might be sometimes due on the borrower’s next payday. They are simple to obtain and don’t require a credit score check.

– Pros: Quick entry to cash, minimal documentation, and no credit score test.

– Cons: Extraordinarily excessive-interest rates and charges, potential for a debt cycle if not repaid on time.

- Installment Loans:

– Overview: Installment loans allow borrowers to receive a lump sum of cash that is paid back in fastened monthly installments over a set interval.

– Pros: Extra manageable repayment phrases compared to payday loans, usually out there for bigger quantities.

– Cons: Increased interest charges than traditional loans, potential for late fees.

- Title Loans:

– Overview: Title loans require the borrower to use their vehicle as collateral. The loan quantity is usually based mostly on the vehicle’s worth.

– Pros: Quick entry to funds, no credit test, and the ability to maintain the automobile while repaying the mortgage.

– Cons: Threat of losing the car if the loan just isn’t repaid, high-curiosity rates.

- Money Advances:

– Overview: A money advance is a short-time period mortgage obtained by a bank card. Borrowers can withdraw cash as much as a certain restrict.

– Execs: Immediate access to money, no credit verify required.

– Cons: Excessive-curiosity rates and fees, and it might negatively impression credit utilization.

Leading Providers of No Credit Verify Loans

- LendingPoint:

– Overview: LendingPoint offers private loans with versatile terms and no strict credit requirements.

– Loan Amounts: $2,000 to $25,000.

– APR: Ranges from 15% to 35%.

– Repayment Phrases: 24 to forty eight months.

- CashNetUSA:

– Overview: CashNetUSA provides payday loans and installment loans with no credit verify.

– Loan Amounts: $One hundred to $3,500.

– APR: Varies by state, but can exceed 400%.

If you cherished this article and you would like to be given more info relating to loans no credit Check guaranteed approval (https://bestnocreditcheckloans.com) nicely visit our own webpage. – Repayment Phrases: Varies from a number of weeks to several months.

- OneMain Financial:

– Overview: OneMain Financial gives personal loans with flexible terms and no credit check for certain borrowers.

– Loan Quantities: $1,500 to $20,000.

– APR: 18% to 35.99%.

– Repayment Phrases: 24 to 60 months.

- TitleMax:

– Overview: TitleMax makes a speciality of title loans and allows borrowers to leverage their car for cash.

– Mortgage Quantities: $300 to $10,000.

– APR: Varies by state.

– Repayment Phrases: Sometimes 30 days, but could be prolonged.

Pros and Cons of No Credit Test Loans

Professionals:

- Fast Access to Cash: These loans often have a fast approval course of, allowing borrowers to receive funds inside hours.

- No Credit Historical past Limitations: People with poor or no credit score can still qualify for a mortgage.

- Versatile Use: Funds can be used for varied purposes, together with emergencies, bills, or unexpected bills.

Cons:

- High-Interest Rates: Many no credit score check loans come with considerably increased interest charges than conventional loans, making them costly in the long term.

- Threat of Debt Cycle: Borrowers might discover themselves in a cycle of debt, especially with payday loans that require repayment in full quickly.

- Restricted Loan Amounts: No credit score examine loans could provide lower quantities than traditional loans, which could be inadequate for larger expenses.

Issues to consider Earlier than Making use of

- Consider Your Financial Scenario: Before taking out a no credit examine loan, assess your monetary needs and decide if you may afford the repayment phrases.

- Research Lenders: Not all lenders are the same. Search for reputable lenders with clear phrases and circumstances. Read opinions and check for any complaints.

- Understand the Phrases: Rigorously assessment the loan settlement, together with interest charges, charges, and repayment schedules. Ensure you understand the overall value of the mortgage.

- Consider Options: Discover different borrowing options, comparable to credit score unions, peer-to-peer lending, or private loans from mates or household, which can provide higher terms.

- Plan for Repayment: Create a funds to make sure you can meet the repayment terms with out falling into a debt cycle.

Conclusion

No credit score test loans is usually a lifeline for people going through monetary emergencies or who lack access to conventional credit. However, they come with important dangers, together with excessive-curiosity charges and the potential for a cycle of debt. It is crucial for borrowers to conduct thorough analysis, perceive the phrases, and consider their financial conditions before proceeding with such loans. By being knowledgeable and cautious, individuals can make better financial decisions that align with their wants and circumstances.

No listing found.