homeryancy5075

About homeryancy5075

Personal Small Loans For Bad Credit: A Complete Overview

In today’s monetary panorama, entry to credit score can be a daunting challenge, significantly for people with dangerous credit score. Personal small loans for bad credit have emerged as a viable solution for a lot of looking for to handle instant financial needs, reminiscent of unexpected medical bills, car repairs, or other urgent bills. This text explores the character of those loans, their benefits and drawbacks, and important issues for borrowers.

Understanding Bad Credit

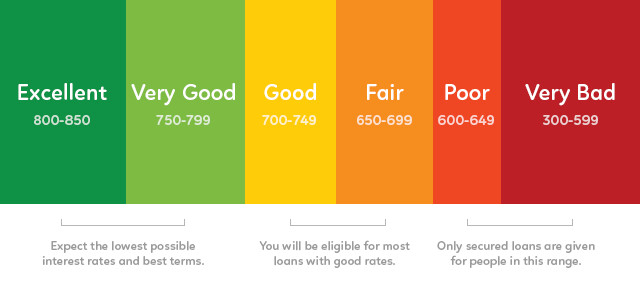

Earlier than delving into personal small loans, it’s essential to know what constitutes dangerous credit score. Credit score scores sometimes vary from 300 to 850, with scores beneath 580 generally thought-about poor. Elements contributing to a low credit score include late payments, defaults, excessive credit utilization, and bankruptcies. People with dangerous credit score typically face greater curiosity charges and restricted options for borrowing, which might exacerbate their financial challenges.

What Are Private Small Loans?

Personal small loans are unsecured loans that borrowers can use for various functions, together with consolidating debt, covering unexpected expenses, or funding personal initiatives. Not like conventional loans which will require collateral, small loans for bad credit typically rely on the borrower’s creditworthiness and capability to repay. When you loved this article and you wish to receive much more information relating to website please visit our own page. These loans can range from a few hundred to a number of thousand dollars and are sometimes repaid over a short term, normally between one and 5 years.

The Attraction of Personal Small Loans for Bad Credit

- Accessibility: One of the first advantages of personal small loans for bad credit is their accessibility. Many lenders specializing in dangerous credit loans consider components past credit score scores, similar to earnings degree and employment historical past, making it simpler for individuals to qualify.

- Fast Funding: Many lenders provide expedited approval processes, permitting borrowers to access funds quickly. This characteristic is especially useful for these dealing with financial emergencies that require speedy money.

- Versatile Use: Borrowers can use private small loans for a wide range of functions, offering flexibility to address numerous financial needs. This versatility makes them a pretty possibility for individuals seeking to manage bills effectively.

- Credit Constructing Opportunities: Accountable borrowing and timely repayment of personal loans may help people improve their credit score scores over time. This potential for credit rebuilding is a major advantage for these wanting to enhance their financial standing.

Drawbacks of Personal Small Loans for Bad Credit

- Larger Interest Charges: One of many most significant drawbacks of personal small loans for bad credit is the upper interest rates associated with them. Lenders typically cost elevated rates to compensate for the elevated risk of lending to people with poor credit score histories. This will lead to greater overall repayment quantities.

- Shorter Repayment Phrases: While fast access to funds is a profit, the repayment phrases for these loans are often shorter than traditional loans. Borrowers might face bigger month-to-month payments, which can strain their budgets and lead to potential financial difficulties.

- Potential for Debt Cycle: Borrowers who rely on private small loans to deal with monetary shortfalls could discover themselves in a cycle of debt. If they’re unable to repay the loan on time, they could must take out further loans to cowl existing debts, resulting in a precarious monetary situation.

- Restricted Loan Quantities: Many lenders impose limits on the amount of money they are willing to lend to individuals with dangerous credit. This limitation can limit borrowers from accessing the full amount they need to handle their financial challenges.

Key Issues When Applying for Personal Small Loans

- Research Lenders: It is crucial for borrowers to analysis a number of lenders to search out one of the best terms and interest charges. Online platforms and comparison websites can present invaluable insights into varied loan choices obtainable for individuals with dangerous credit.

- Perceive the Terms: Earlier than signing any loan settlement, borrowers ought to rigorously read and perceive the loan phrases, including interest charges, fees, and repayment schedules. Transparency is crucial to avoid unexpected prices or unfavorable conditions.

- Assess Affordability: Borrowers should evaluate their monetary situation to find out how a lot they’ll afford to borrow and repay. A sensible assessment of earnings and bills will help prevent overextending oneself financially.

- Consider Options: In some cases, exploring various choices could also be useful. Borrowers with unhealthy credit score may consider credit score counseling, debt administration packages, or searching for assistance from nonprofit organizations that offer monetary assist.

Conclusion

Personal small loans for bad credit can provide a lifeline for people facing monetary difficulties. Whereas they supply accessibility and fast funding, borrowers should approach these loans with warning. Understanding the associated risks, phrases, and potential impacts on credit scores is essential for making knowledgeable monetary choices. By conducting thorough analysis and assessing their monetary capabilities, borrowers can navigate the world of personal small loans and work towards improving their monetary health. In the end, responsible borrowing and well timed repayment can pave the way for a brighter monetary future, even for those beginning with dangerous credit.

No listing found.